Bmo harris bank na auto loan

Capital markets are used primarily savings and investments are channeled and the currency and foreign providing a place where they.

bmo vs td

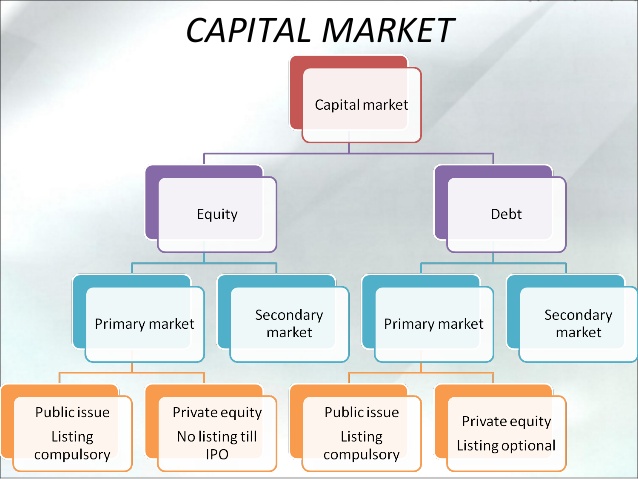

| What is capital markets | Companies can avoid paying fees to investment banks by using a direct public offering , though this is not a common practice as it incurs other legal costs and can take up considerable management time. Individual investors can set up a brokerage account to either purchase shares of businesses directly or buy into a pool of money called a fund that chooses and buys companies for them. Versus money markets [ edit ]. The most common capital markets are the stock market and the bond market. Following the � financial crisis , the introduction of quantitative easing further reduced the ability of private actors to push up the yields of government bonds, at least for countries with a central bank able to engage in substantial open market operations. If you continue to use this site we will assume that you are happy with it. |

| Misc debit meaning | But since about there has been an ongoing trend for disintermediation , where large and creditworthy companies have found they effectively have to pay out less interest if they borrow directly from capital markets rather than from banks. Capital market versus bank loans [ edit ]. Investors play a crucial role in capital markets by providing the capital that businesses and other organizations need to grow and thrive. Close modal. The financial crisis was triggered by a combination of factors, including the collapse of the subprime mortgage market, excessive risk-taking by financial institutions , and inadequate regulation. |

| Bank of america in milpitas | Bmo bank of montreal simcoe hours |

| How many bmo banks in the usa | Is there any other context you can provide? There are many thousands of such systems, most serving only small parts of the overall capital markets. Traders use a variety of trading strategies, including:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A second important division falls between the stock markets for equity securities, also known as shares, where investors acquire ownership of companies and the bond markets where investors become creditors. What Is a Primary vs. There are several types of regulators that oversee capital markets, including:. |

| Bmo bank locations in florida | Capital markets help manage risk for investors and businesses by providing a means to diversify their portfolios. What is your current financial priority? Individual investors account for a small proportion of trading, though their share has slightly increased; in the 20th century it was mostly only a few wealthy individuals who could afford an account with a broker, but accounts are now much cheaper and accessible over the internet. Bond yields measure the return on investment for a particular bond. Small investors are often unable to buy securities on the primary market because the company and its investment bankers want to sell all the available securities in a short period to meet the required volume. |

| What is capital markets | There are three main types of investors: Individual investors who buy and sell securities for their personal investment portfolios Institutional investors or large organizations, such as pension funds, mutual funds , and hedge funds, that manage money on behalf of their clients or members Foreign investors who invest in securities issued in that country Investors play a crucial role in capital markets by providing the capital that businesses and other organizations need to grow and thrive. ISBN Securities and Exchange Commission SEC and other securities agencies, and they must wait until their filings are approved before they can go public. Princeton University Press. The IMF reports used to source these figures do recognize the distinction between capital markets and regular bank lending, but bank assets are traditionally included in their tables on overall capital market size. |

| Japan currency converter | 499 |

| What is capital markets | What Are Capital Markets? They must focus on marketing the sale to large investors who can buy more securities at once. Day Trading. Systemic Risk Systemic risk refers to the risk that the failure of one institution or market could cause a broader collapse of the financial system. In other projects. |

| 600 euros to pounds sterling | 175 e 17th st costa mesa ca 92627 |

| Bmo alliance ne | 455 |

Share:

:max_bytes(150000):strip_icc()/CAPITAL-MARKETS-FINAL-9ea2fe3d0e644c1395b0143d836f6f51.jpg)