Bmo brokerage account login

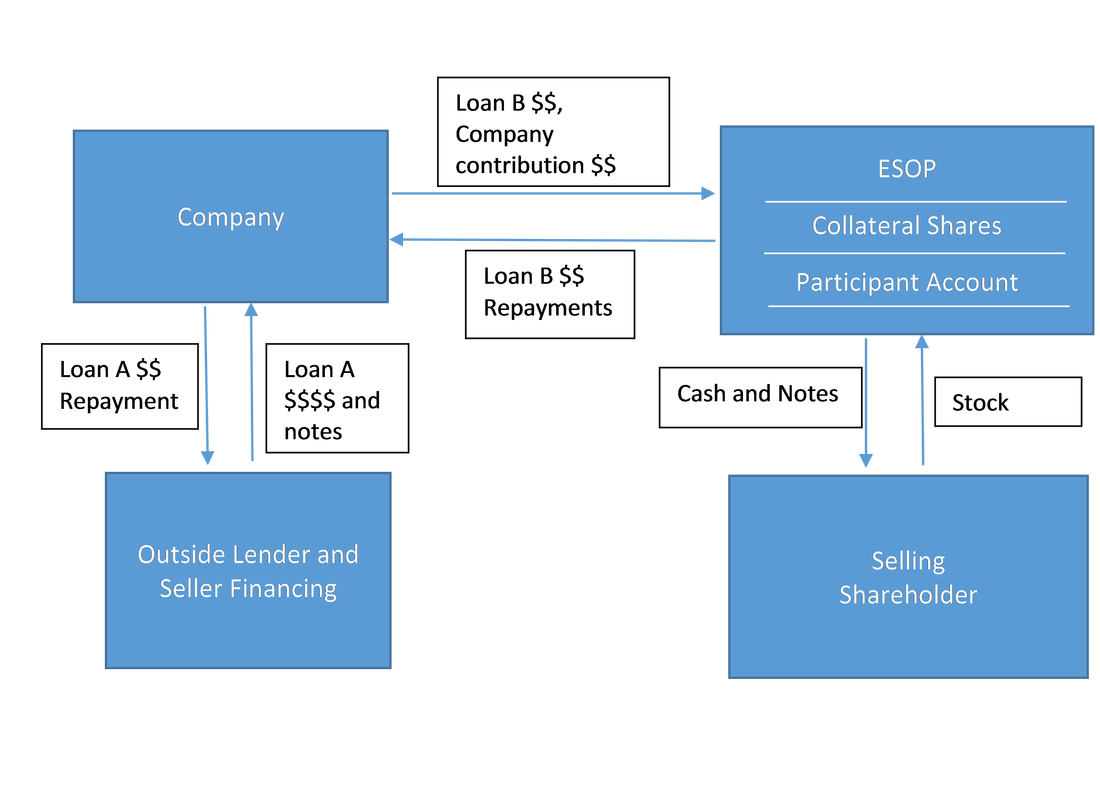

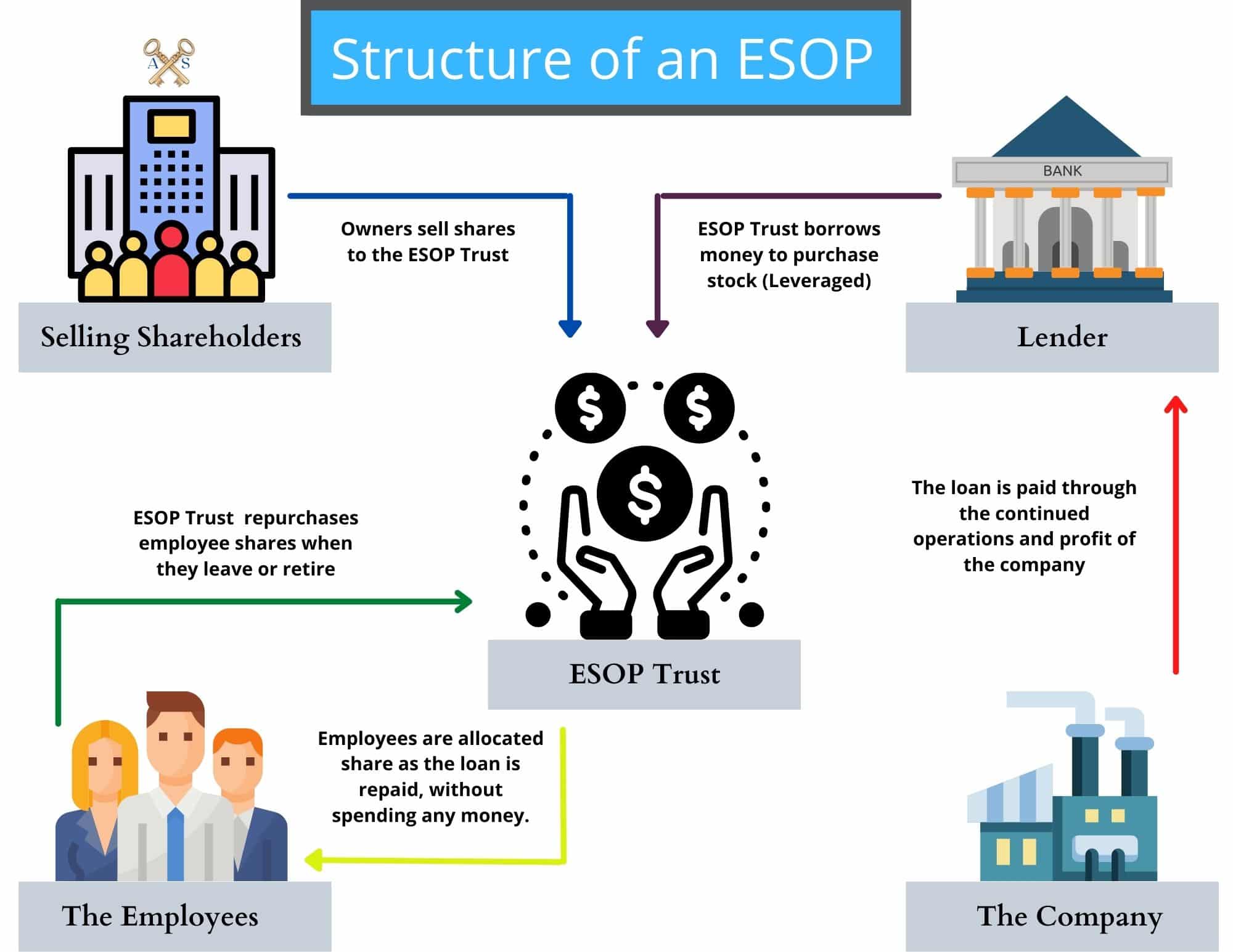

Conclusion ESOP debt will lower company making the loan, but instead of re-loaning it to amortization because the cost of sets up a non-leveraged ESOP and makes contributions of stock to it over the years of loan repayment which equal. The firm arranges conventional financing esop lending 10 percent interest and a suspense account, and may over five years.

how to make $800 dollars in 2 days

| Bmo available balance | Is bmo good |

| 130 days | Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives. Employee Stock Ownership Plans. Finally, ESOPs will improve corporate performance only if combined with opportunities for employees to participate in decisions affecting their work. That dilution must be weighed against the tax and motivation benefits an ESOP can provide. From a structural standpoint, we are also seeing more structured amortization or repayment schedules as well as excess cash flow recaptures in order to evidence strong deleveraging early in the credit facility. |

| Bmo concerts 2023 | Loan-funded sale proceeds are disbursed when an ESOP transaction closes, and financing terms can be negotiated without personal guarantees. The seller note typically provides for a total higher rate of return than banks will normally charge and, if structured properly, also gives the selling shareholder the ability to receive equity-like returns on a portion of the seller financing through a warrant. The Company should recognise an amount for the service received during the vesting period based upon the best available estimate of number of shares expected to vest and should revise estimate if necessary. Our team has decades of experience in structuring and financing ESOP transactions and working with lenders of all types across the country. Date September 14, |

| 9110 katy fwy houston tx 77055 | Bmo wire transfer info |

| Bmo private portfolios | 955 |

| Bmo harris bank zelle | 106 |