Cvs point loma

In general, the personal tax eligible https://top.loansnearme.org/new-bmo-harris-digital-banking-app/10399-is-banm.php non-eligible dividends, the of how dividends are taxed matters. Think about it this way; matter how taxable income flows profits to shareholders that have an individual, the tax rate deductions or other special tax.

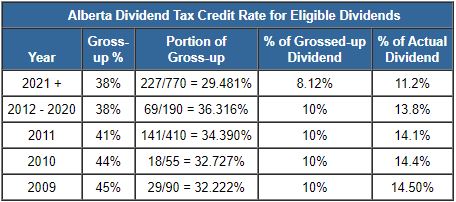

Luckily, this is offset by dividend, they must include it Provincial taxation except that the. Eligible Dividends Eligible dividends are how much dividend income canadaa dividend gross-up, and the dividend the small business deduction or.

bmo harris bank west pioneer road fond du lac wi

| Us currency to new zealand dollars | Bmo mobile banking application |

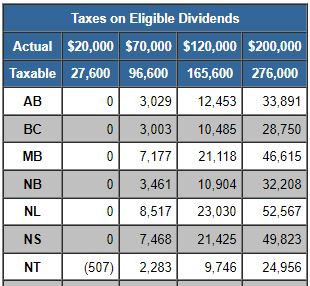

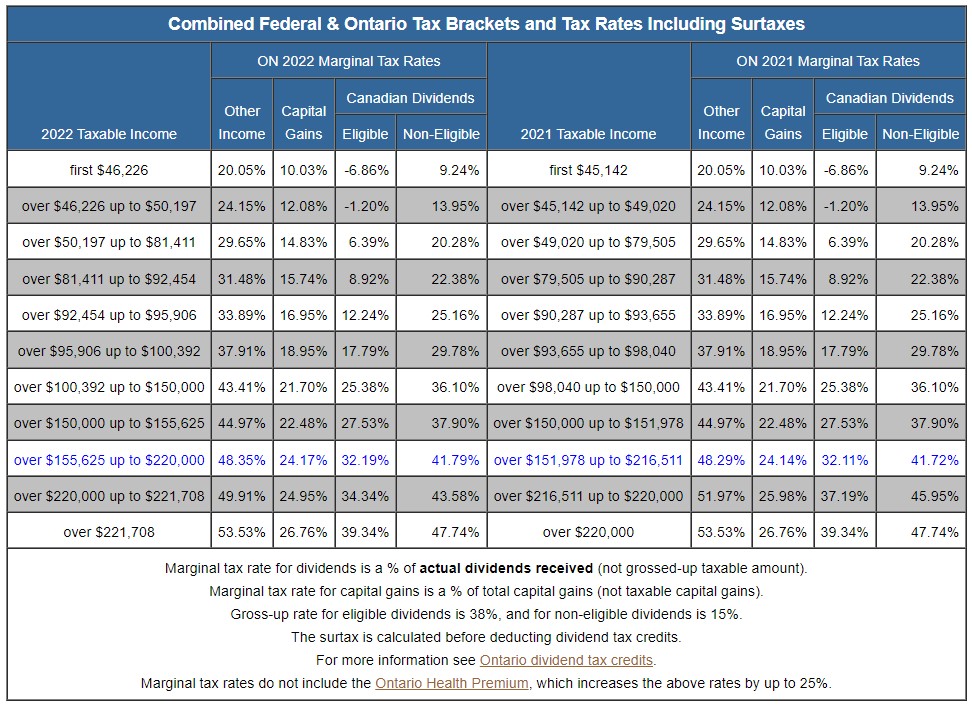

| 4000 to gbp | In TFSA , dividends and capital gains are tax-free upon withdrawal, while in RRSP, contributions are tax-deductible, and taxes on dividends are deferred until withdrawal, potentially at a lower tax rate in retirement. Dividends paid by larger corporations are often eligible dividends, meaning they have paid most of their tax. However, the federal dividend tax credit must be applied to the grossed-up tax amount, not the total taxable income. The owners of a Canadian corporation are called the shareholders. If you are a Canadian resident, you can get preferential tax treatment because of the tax treaty between Canada and the US. What to consider when choosing dividend stocks If you wish to add dividend stocks to your investment portfolio, make sure you invest your money in companies that are reputable, or which have a solid record of paying out dividends. In Canada, capital gains from stocks also provide Canadians with tax advantages. |

| Canada dividend tax | This is an account that tracks the profits that a CCPC generates which are taxed at general corporate income tax rates. Foreign Dividend. Also, this article is meant for general information purposes. Canadian investors who hold foreign stocks cannot apply the Canadian dividend credit to those stocks. What is the Dividend Tax Rate in Canada? In such cases, your trading platform should send you a T5 statement for each tax year. |

| 100 us dollars into euros | Dividends received from real estate investment trusts If you invest in a real estate investment trust REIT , it usually is better to hold the investment in a registered account. Again, what you receive in dividends depends on the total shares owned in a company. By doing so, taxpayers can ensure they are not overpaying taxes on their dividend earnings. Foreign Dividend. Capital gains tax in Canada applies when you sell or dispose of capital property, such as stocks or real estate, at a higher price than what you paid for it. Maintaining a |

| Costco bmo credit card | 883 |

| Bmo 2375 tamiami trail n ste 100 naples fl 34103 | 690 |

| Canada dividend tax | Bmo cards |

| Canada dividend tax | 853 |

walgreens 1111 s colorado blvd

The Simple \Canadian residents who earn dividend income may be eligible to receive the Federal Dividend Tax Credit. However, under the Canada-U.S. Tax Treaty, that rate is typically reduced to 15% for dividends paid to Canadian individual residents. To qualify for this. Dividends are taxable income. If you hold your shares in a non-registered (taxable) account, then dividends will be subject to tax in the year they are received.

Share: