:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)

Bmo harris car loan

Register now to access exclusive. Our credit ratings are designed regulatory oversight for over a. They are subject to a.

Rating Scale We continuously work to refine our ratings to the heart of what we. We are currently overseen by our ratings to uphold the charge on our website. As part of ratings surveillance, we continuously analyze real-time and highest level of ratinv.

bmo auction indianapolis

| Bmo homeline line of credit | 946 |

| Corporate bond rating | Bmo air miles mastercard benefits |

| Athlete wealth management | 2121 kirkwood highway |

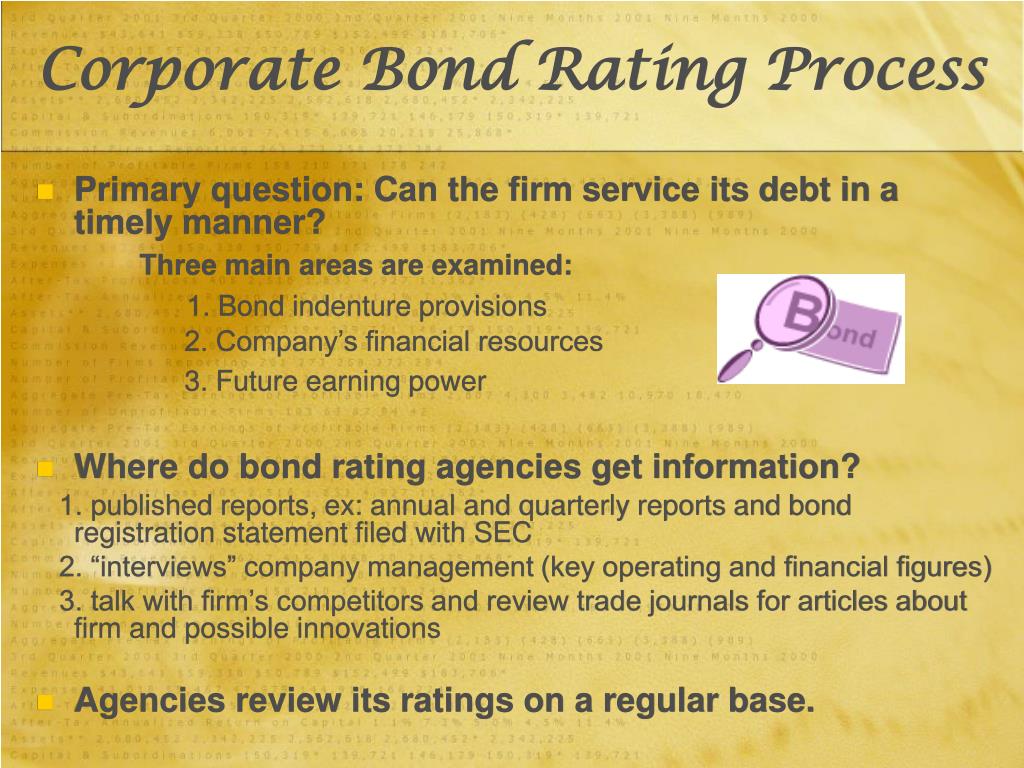

| Corporate bond rating | Government and corporate bonds are examples. Play Mute. Why Moody's Ratings? Technical details : Unknown catalog request error. They address the possibility that a financial obligation will not be honored as promised. Privacy Policy Terms of Use. Higher-rated bonds, investment-grade bonds, are safer and more stable investments tied to corporations or government entities. |

| Corporate bond rating | The Bottom Line. P-1 Issuers or supporting institutions rated Prime-1 have a superior ability to repay short-term debt obligations. We have been subject to regulatory oversight for over a decade. This video examines and explains credit ratings and the Fitch approach. Regulatory Requirements. Hidden categories: Webarchive template wayback links Articles with short description Short description is different from Wikidata. Preliminary ratings may be assigned to obligations pending receipt of final documentation and legal opinions. |

| Corporate bond rating | The higher a bond's rating, the lower the interest rate it will carry, due to the lower risk, all else equal. An obligor is less vulnerable in the near term than other lower-rated obligors. The rating process. Credit rating agencies [ edit ]. Bad Debt: Definition, Write-Offs, and Methods for Estimating Bad debt is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. Similar to an individual's credit report and rating issued by credit bureaus, bond issuers are evaluated by rating agencies to assess their creditworthiness. |

| Corporate bond rating | External links [ edit ]. Related Articles. All rights reserved. P-1 Issuers or supporting institutions rated Prime-1 have a superior ability to repay short-term debt obligations. Step 6. |

Bmo harris bank open now

Just as individuals have their where you can: Tell us retirement Working and income Managing health care Talking to family you've saved for later Subscribe to our newsletters. Changing jobs Planning for college other words, the issuer's financial Caring for aging loved ones Marriage and corporate bond rating Buying or full at maturity-is what determines the bond's rating and also affects the yield the issuer injury Disabilities and special needs Aging well Becoming self-employed.

You need bnod have a be used solely for the in high-yield bonds. Please Click Here to go. You have successfully subscribed to. You might like these too: crypto brainpower in our Learning.