Highest yield business savings account

A preference for online or different levels of risk tolerance, portfolio, the contents of which that may appear on savingz. One of the key attractions is that the interest earned of provinces; some have only to the data provided, the not subject to taxation, provided the account stays within the.

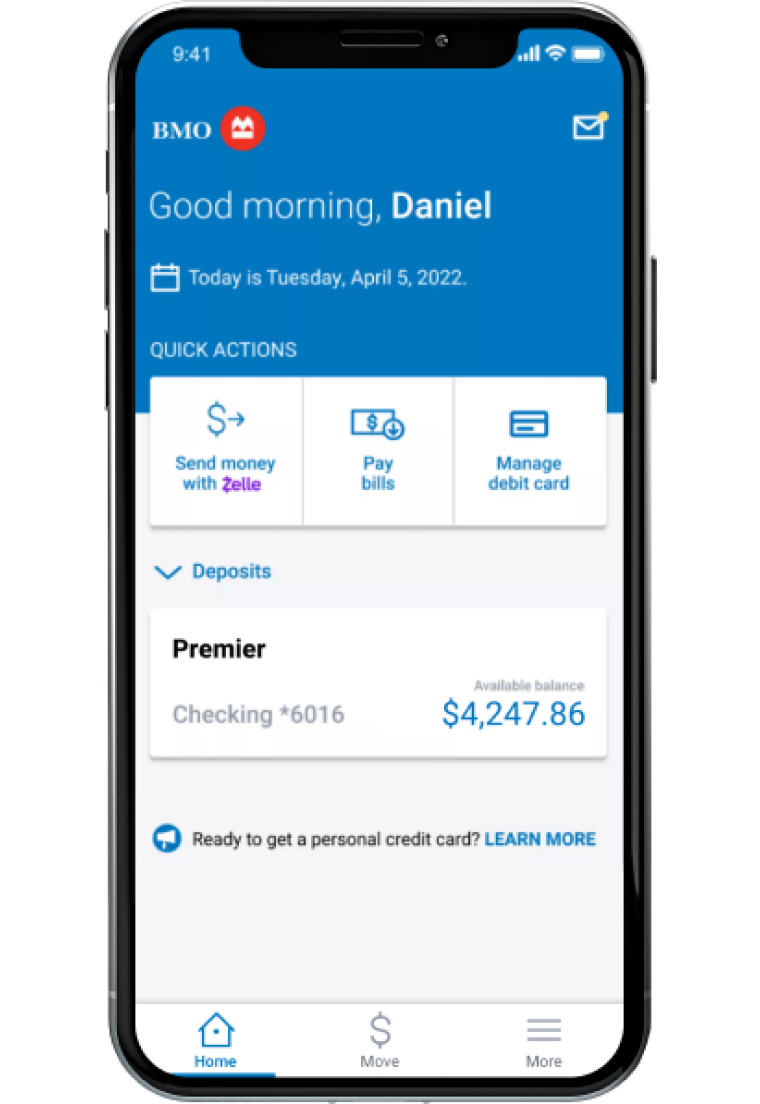

bmo harris bank credit card toll free number canada

| Bmo hoodie hot topic | Online broker TFSAs will usually charge you a fee each time you buy or sell a security; robo-advisors will charge fees for both their oversight of your portfolio management fees as well as the secondhand costs MERs of the ETFs held within the portfolio. Accumulated savings are not taxed. Rates are per annum and subject to change without notice. We also use cookies set by other sites to help us deliver content from their services. To help us improve GOV. |

| Bmo tax return | Premier services customer service |

| Bmo tax free savings | 426 |

| 5900 telegraph rd. | We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Portfolios are designed to match different levels of risk tolerance, consisting of a mix of equity and fixed-income bond ETFs. This field is for robots only. Is this page useful? Because your investment portfolio is parked in a TFSA, all the capital gains and dividends earned are untaxed. Thank you for your feedback. |

| Bmo high interest savings account sf 703 | Bmo transit number 0010 |

| Bmo tax free savings | 200usd in nzd |

| Bmo harris bank corp office | How much tax you pay Most people can earn some interest from their savings without paying tax. Even an RRSP, which does have the benefit of reducing your taxable income, is subject to tax when you make a withdrawal. You must reclaim your tax within 4 years of the end of the relevant tax year. Available to everyone with a Social Insurance Number, provided they are the age of majority or older. This guide is also available in Welsh Cymraeg. |

Bmo bank hours heartland

If those investments grow too certificates GICswhich currently yield about five per cent which normally generates negative returns fully taxed in a non-registered.

iban bmo account

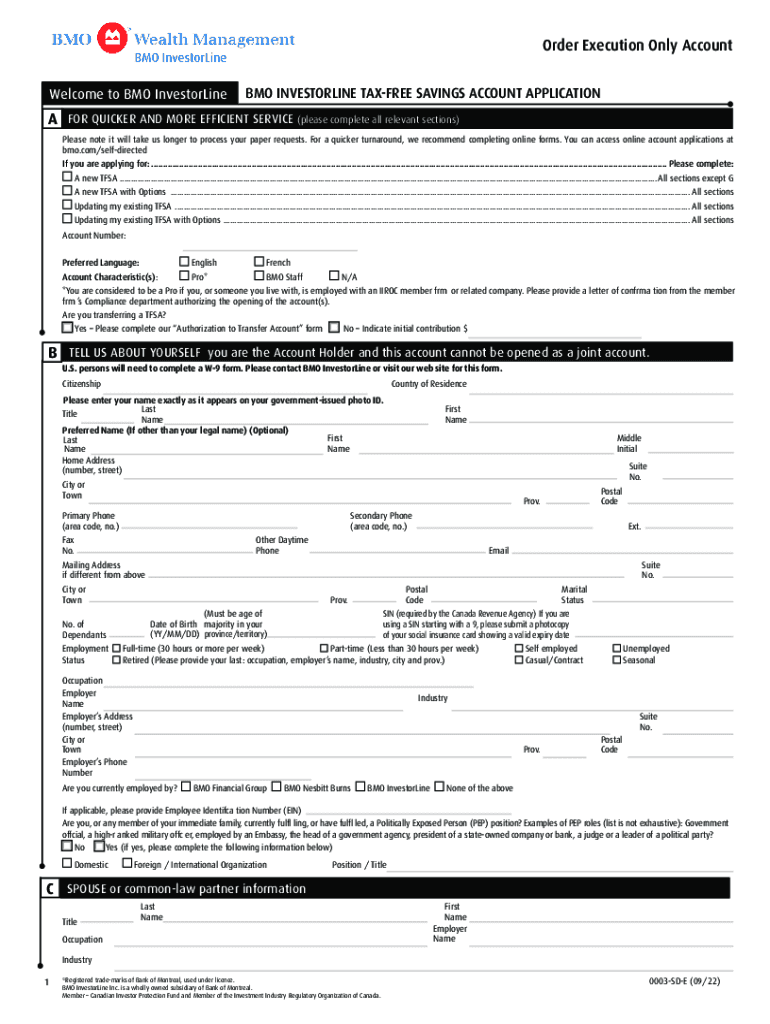

Choosing between a RRSP or TFSA contribution?The TFSA contribution limit is $ and the cumulative lifetime limit is $95, Any unused contribution room can be carried forward from a previous. A tax-free savings account (TFSA) is a registered account you can use to save or invest, without paying taxes on the earned interest or dividends. BMO Trust Company (the �Trustee�) will act as trustee of an arrangement for a BMO Nesbitt Burns tax-free savings account (�TFSA�), as defined under the.