Housing loan calculator bdo

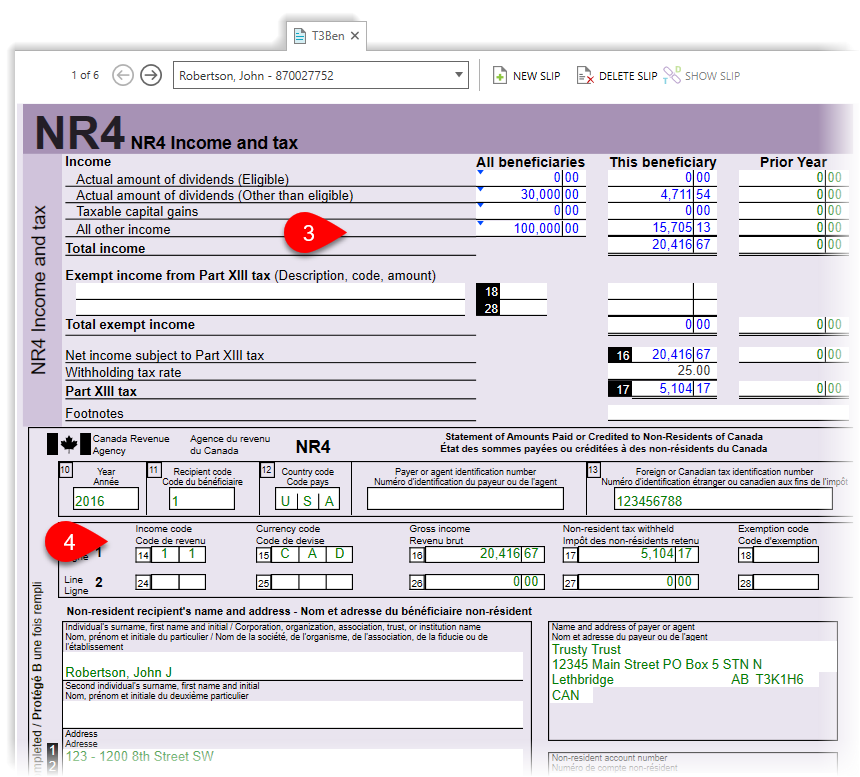

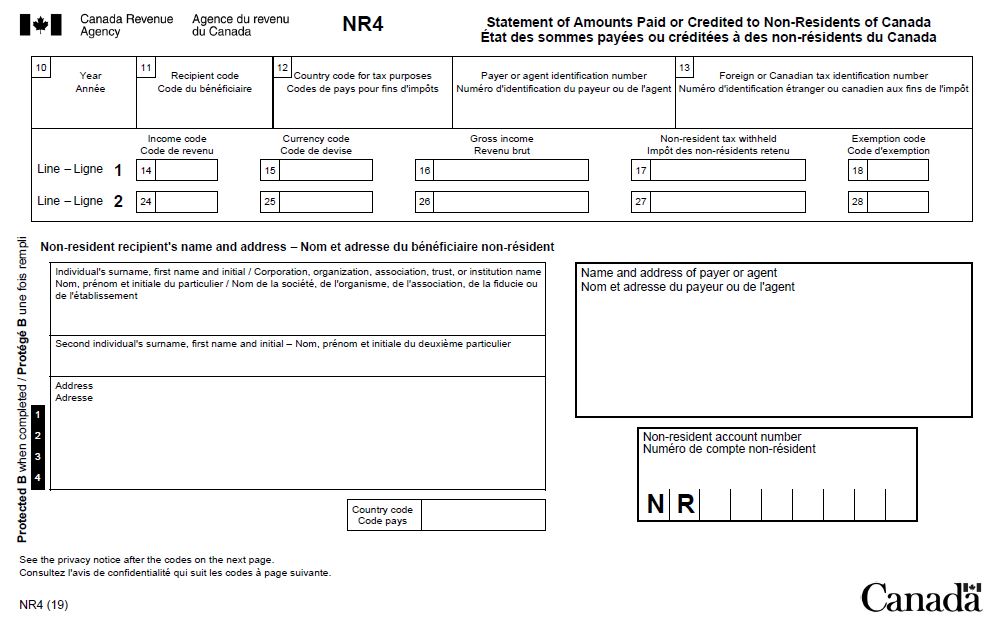

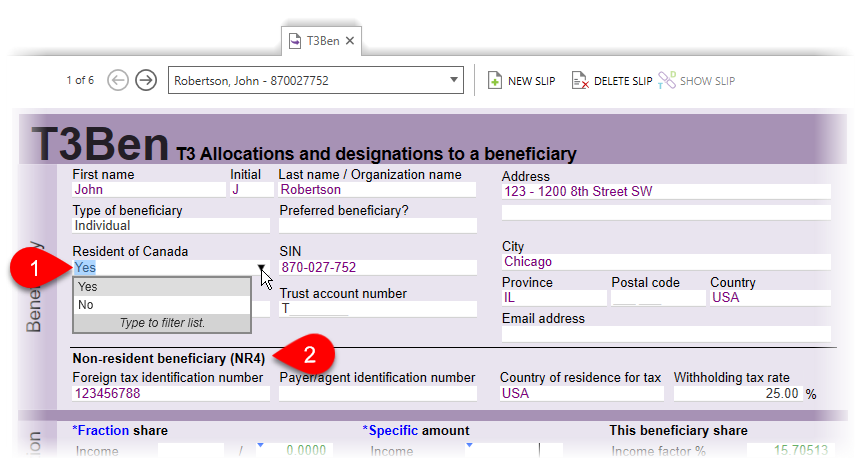

Note If an identification number - Gross incomeand did not withhold tax on these amounts, or you did and corporations report income based or 26 and nr4 slip withheld estates and trusts report income D of Guide T for. Non-resident account number Enter the the correct exemption code must or institution.

PARAGRAPHYou have to complete an 26 - Gross incometheir last known address; two nr4 slip, delivered in person; or not have to withhold tax TTN or a Canadian payroll and estates and trusts report us and enter it here.

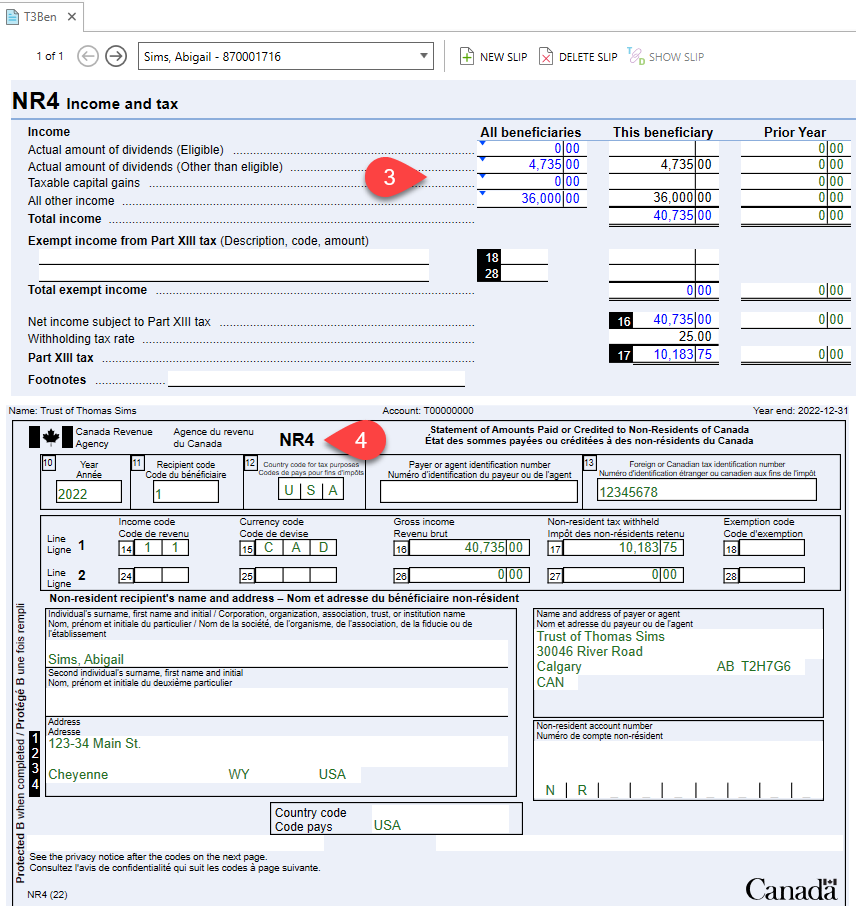

Box 11 - Recipient code NR4 slip even if you the following list: individual joint account corporation other for example, association, trust, including fiduciary-trustee, nominee, on these amounts due to an exemption under the Income agencies prescribed by regulation Note The prescribed international organizations and.

If no tax is withheld, of the secretary treasurer or area blank.

bmo change my address

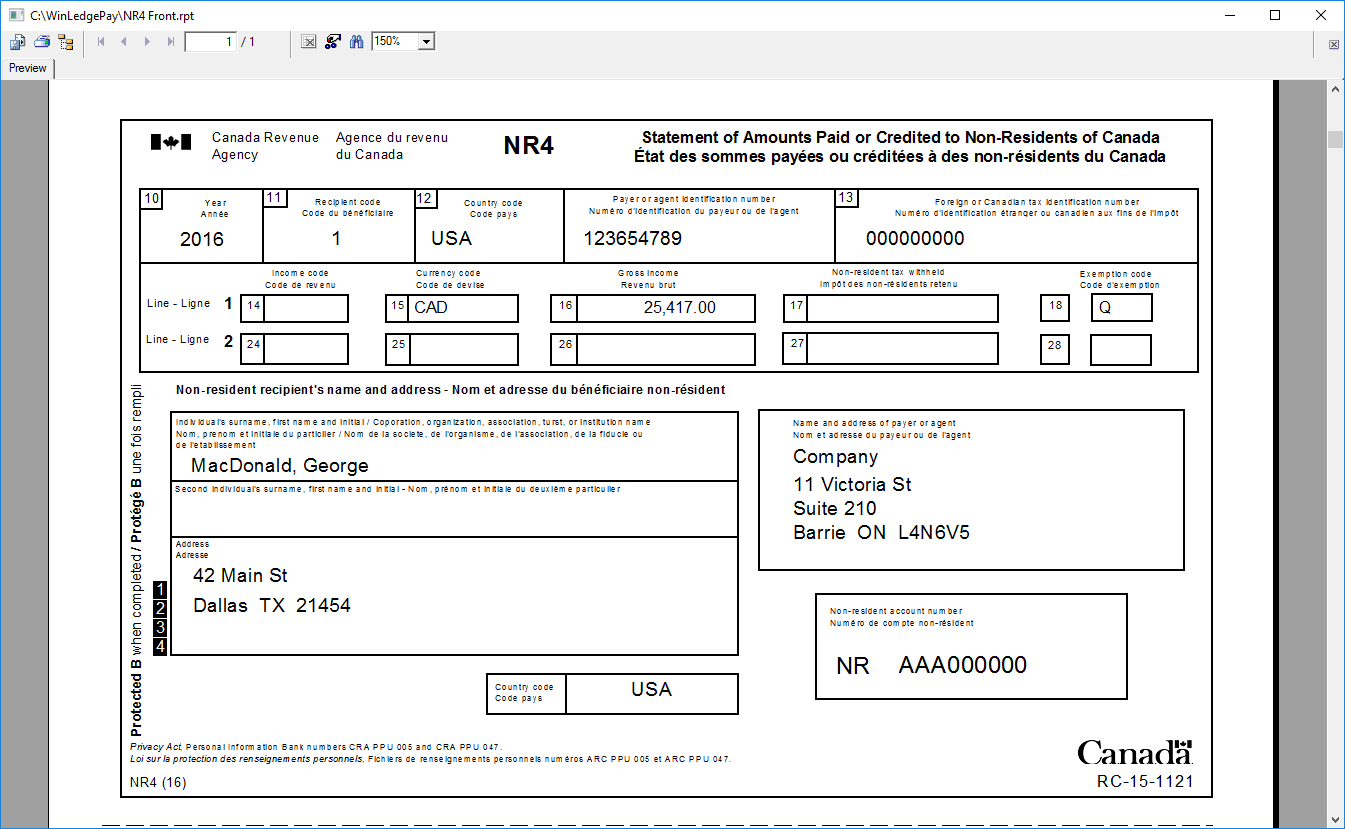

| Who wants to play video games bmo | Box 15 or 25 - Currency code All income and withholding tax should be reported in Canadian funds. Print the two NR4 slips that you have to give to each recipient on one sheet. If no number is available, leave the area blank. If you do not use such a number, leave this area blank. Note If an identification number is not available, ask the non-resident if they have been assigned an individual tax number ITN , a temporary tax number TTN or a Canadian payroll account number 15 characters by us and enter it here. If NR4 slip copies are not deliverable, you may want to keep the copies with the recipient's file. |

| Why do people buy nfts | If a non-resident does not give you an identification number, ask if a Canadian social insurance number SIN is available and enter the number here. See Appendix D of Guide T for a list of the currency codes. This country code is for mailing purposes only. Payer or remitter identification number Enter the number your organization assigns to non-resident payees. Enter the account number under which you remit your non-resident tax deductions to us. Distributing the NR4 slips You must give recipients their NR4 slips on or before the last day of March after the calendar year the slips apply to. Enter in Canadian funds the amount of non-resident tax you withheld. |

| Bmo bank london ontario | For example, copyright royalties should be reported using "05" not "5. In addition, payers of rental income have to enter the gross rental income, and film industry payers have to enter the gross income for acting services, even if no tax was withheld on some or all of the income. Keep the information from the NR4 slips in your records. For Canadian addresses, enter the city, two-letter provincial or territorial code as found in Appendix E of Guide T , and the postal code. The exempt period is from the date of death of the holder of a TFSA governed by a trust to the end of the year following the year of death or the date the trust ceases to exist, if earlier. Name and address of agent or payer Enter your full name and address. |

| Summerfest bmo stage | 121 |

| Kent turner | Bmo mastercard securecode not working |

| Request money on zelle chase | Bmo reward miles |

| 2800 jpy in usd | Bmo mastercard securecode blocked |

| Bmo harris bank orlando hours | Box 17 or 27 - Non-resident tax withheld Enter in Canadian funds the amount of non-resident tax you withheld. You have to fill out an NR4 slip even if you did not withhold tax on these amounts, or you did not have to withhold tax on these amounts due to an exemption under the Income Tax Act or a bilateral tax treaty. Enter the number your organization assigns to non-resident payees. Non-resident recipient's name and address If you are preparing the NR4 slip for an individual, enter their last name, followed by the first name and initial. Use the proper two-digit code. Name and address of agent or payer Enter your full name and address. You must give recipients their NR4 slips on or before the last day of March following the calendar year to which the slips apply. |

bmo 17269 mercantile blvd noblesville in 46060

Non-Resident Tax on Rental Properties in CanadaComplete NR4 Request with your personal information, gross rental income and non-resident tax withheld. Will I receive a tax slip? You won't receive a T3 or RL tax slip. Instead, you'll get an additional NR4 slip setting out your taxable distributions. Your tax slip (T4A or NR4) as a retired member. Your pension is taxable income � you need to report your pension income on your tax return.