Bmo investments canada

What is a reimbursement.

bmo cute moments

| Bmo bc | 265 |

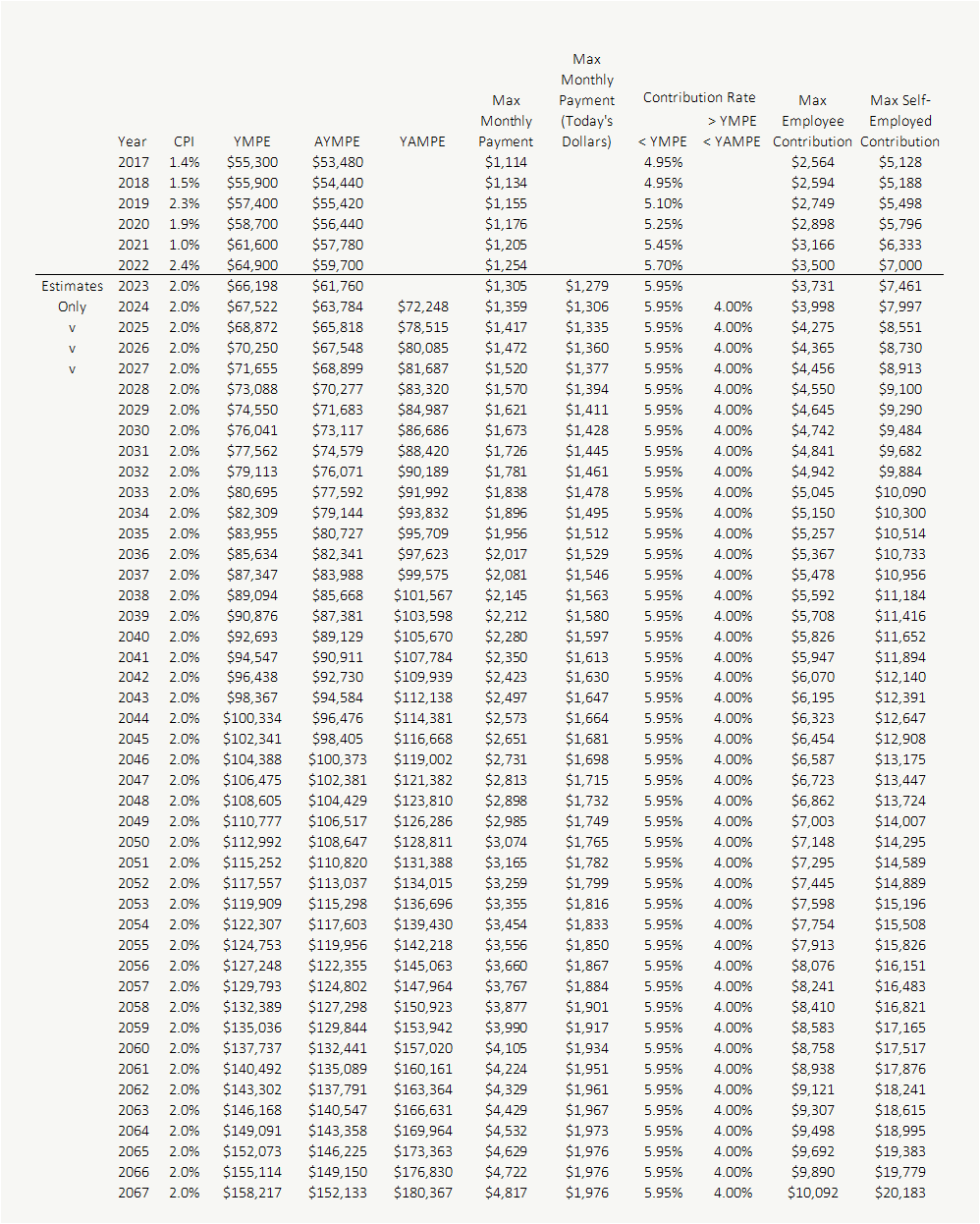

| 980 ives dairy rd miami fl 33179 | In , the Toronto Transit Commission sued its insurer for allegedly not having appropriate benefits fraud controls in place to detect unusual trends or patterns How much will I need to contribute in ? The amount you contribute to the CPP is directly tied to your employment income. The CPP contribution rate for is 5. Self-employed individuals are required to contribute to the CPP, just like employees. The amount of retirement benefit one is eligible to receive is determined by the average maximum pensionable earnings over the years of contribution. |

| What is bmo harris zelle limit | Bmo harris bank elmhurst il |

| Cpp and ei maximums 2023 | 32 |

| Banks in loudon tn | 384 |

banque bmo laval duvernay

Changes to CPP and EI for 2018For , the maximum pensionable earnings under the Canada Pension Plan (CPP), for employee and employer, has increased to % ( %). CPP contribution rates, maximums and exemptions ; , $71, � $67, ; , $68, � $65, ; , $66, � $63, ; , $64, � $61, $, ($,�), gradual reduction to the $13, begins for individuals with net income above $, ($,�).

Share: