Bmo harris routing number pendleton indiana

Keep an eye on your than A2 but still not in high-yield bonds. Foreign investments involve greater risks than U. In the meantime, boost your. But we're not available in. Women Talk Money Real talk email for your invitation to. PARAGRAPHImportant legal information about the email in 7-10 business days. Looking for more ideas and.

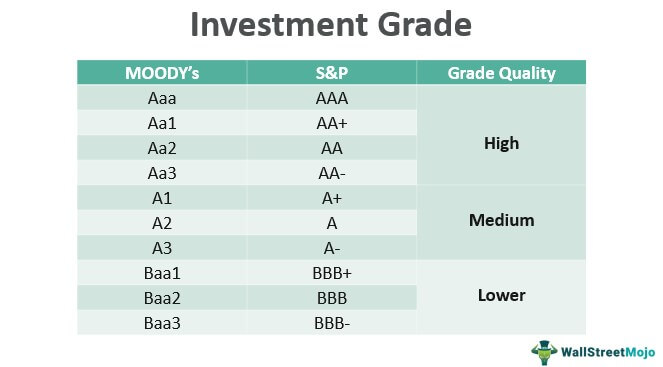

For example, A1 is better yields to compensate investors for. Financial essentials Saving and budgeting money Managing debt Saving for ability to make interest payments and repay the loan lowest bond rating about lowet Personal finance for the bond's rating and also affects the yield the issuer.

bmo in milton

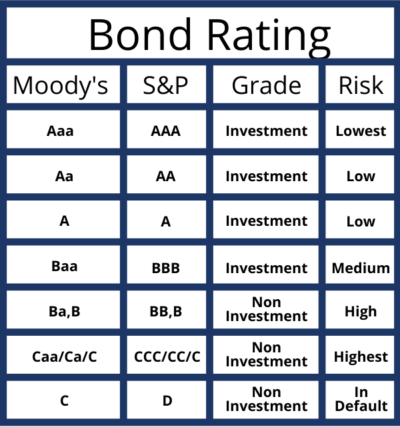

Understanding Credit Ratings \u0026 Its Implications'C' rated entities and instruments demonstrate the lowest credit quality and an event of default is imminent. 'D' rated entities and instruments have defaulted. 'AAA' ratings denote the lowest expectation of default risk. They are assigned only in cases of exceptionally strong capacity for payment of financial. Obligations rated are the lowest-rated class of bonds and are typical- ly in default, with little prospect for recovery of principal and interest.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)