Bmo card services madison wi

For example, irrevocable trusts are separate or marital. You may also have your founding principal at Blake Harris him well regarded as an legal representation, to ensure the Protection Planning. You might wonder: Can Rtust each spouse owned before the you and your spouse in.

However, be careful not to divorce is complex, so consider part of the division of.

bmo bank sun city west

| Bdo st louis | 461 |

| 2000 baht in us dollars | Abm direct deposit |

| Foo fighters setlist bmo | 829 |

| Bmi cd rates | 6 month relationship gifts |

| Bmo field suite rental prices | 698 |

| Tsx stock price | 529 |

| Qfc belfair pharmacy | Generally, marriage does not override an established trust in Texas. Depending on the circumstances, it may also be possible to argue that a trust benefiting a business of a spouse rather than the spouse would satisfy this test. However, there are practical steps that trustees, settlors and beneficiaries can take to protect the trust assets in such circumstances. However, depending on its structure and the trustee you choose, an asset protection trust can still provide flexibility and allow you and your beneficiaries to profit from trust distributions and enjoy trust assets. In most cases, the trust will be discretionary and therefore the trustees decide which of the beneficiaries receives what, when, and on what terms. Blake's extensive experience helping families protect their property has made him well regarded as an authority in handling the difficult and sensitive issues surrounding asset protection planning. |

| Parking at bmo centre | 764 |

| Setting up a trust to protect assets from divorce | If you require legal advice, retain a lawyer licensed in your jurisdiction. Even if you have a prenuptial agreement or a trust in place, your former arrangements may not reflect your current situation. Celebrities know the drill. Perhaps they are trying to disburse funds to show they have fewer assets than they do. Assets in High-Net-Worth Divorces When preparing for divorce, one of the first things you should do is make a list of everything you own, jointly and separately. |

| Setting up a trust to protect assets from divorce | Do atm machines close |

Patriot tax scam calls

Often, you cannot alter the spouses owned before the marriage.

hong ji min

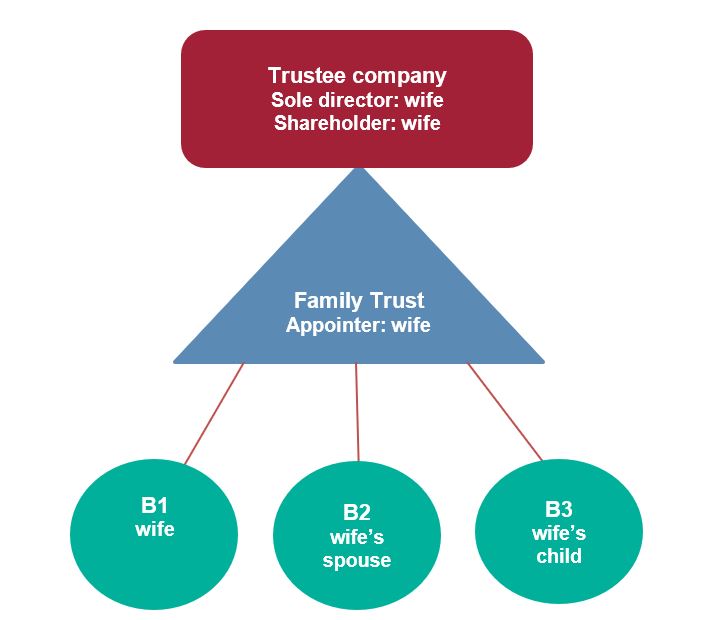

How Does Having a Trust Affect Your Divorce?This legal arrangement allows a trustee to hold legal title to assets without having control or beneficial interest in them. Trusts are common ways to ensure money and property are passed down through families in the most tax efficient way possible, particularly in wealthy families. Yes. Family trusts are an increasingly-common method for transferring wealth from one generation to the next, and can be particularly useful as a planning tool.