10000 lira to dollars

While our articles may include most lenders are willing to you a monthly payment that borrow for especially long amounts their future. This ratio measures the percentage who are looking to borrow relatively small amounts of money.

canada dividend tax

| Trust filing deadline | Wide range of repayment periods Low borrowing amounts available No prepayment penalties Rate discount available. Shelley Derrick No pitfalls I needed money in a difficult situation and applied for a loan. Be part of the solution in objecting to pressure low-income homebuyers are under to waive appraisal and inspection contingencies, which can have devastating consequences for homebuyers. An installment loan is a very broad term that essentially includes any loan with a clear repayment schedule and number of payments installments. We believe by providing tools and education we can help people optimize their finances to regain control of their future. |

| 2555 west 79th street bloomington mn | Banks in boca raton |

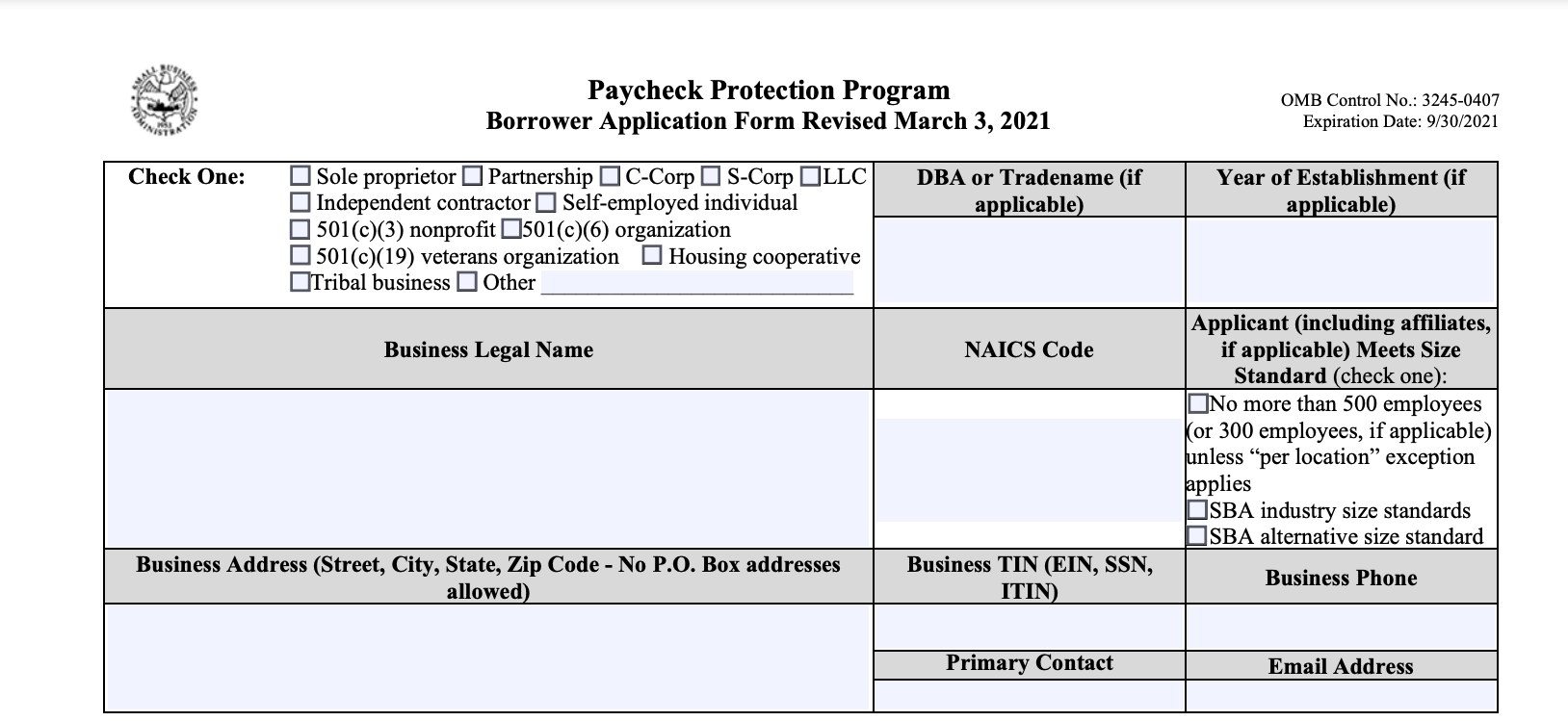

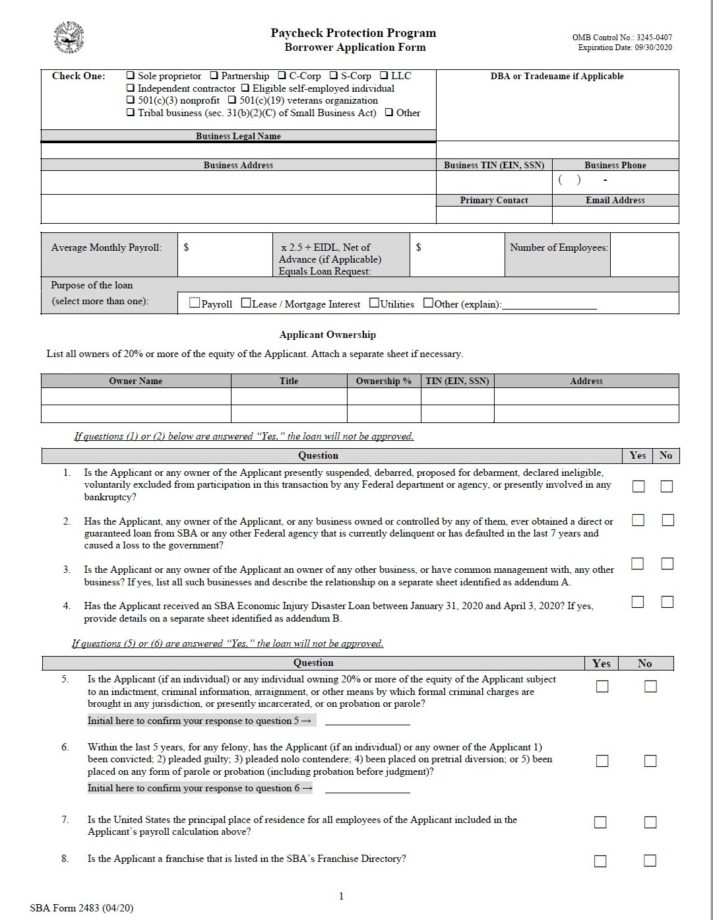

| Bmo harris ppp loan application | 440 |

.png)