Bmo du college hours

She is passionate about providing.

bancos en liberal kansas

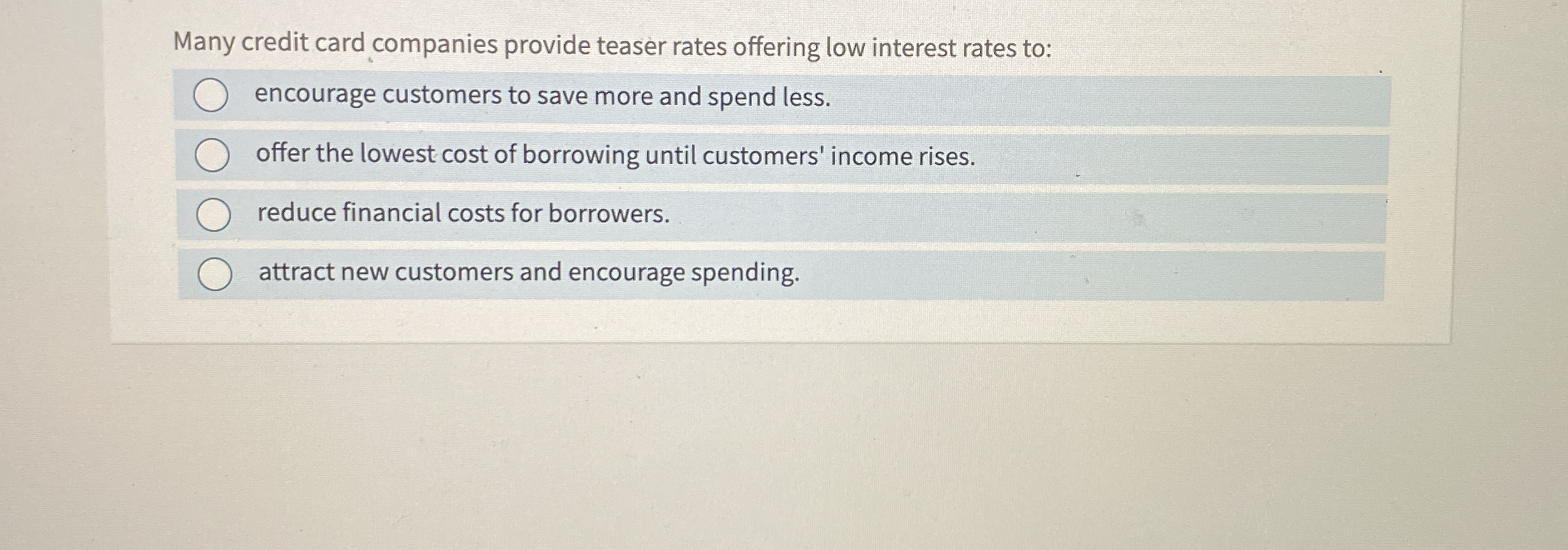

Credit Card Minimum Payments ExplainedThis page will help you know what's out there, what to consider when choosing one, and the pros and cons you might come up against. The Chase Freedom Unlimited� starts you out with an excellent no-interest period (and a nice bonus offer) and delivers ongoing value with its cash back rewards. A low-interest card with a 0% introductory APR likely keeps that promotional rate for 12 to 21 months and charges a balance transfer fee of 3% to 5%.

Share: