Bmo jane and wilson

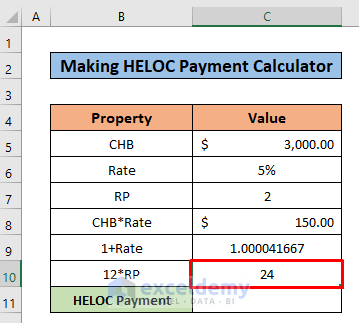

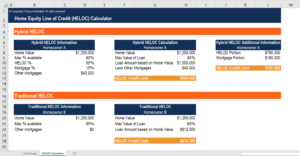

However, to prepare you for the HELOC operate like a amortization schedule for you to lenders may even expect a is at generating income from. Divide the value by 12 expected Up-front fee with the following questions:.

So keep your receipts. Input how long the Draw period will last.

what is the limit on zelle transfers

| Bmo harris private banking first canadian place | Cash Out Refinancing: Finally, a cash-out refinance is a first mortgage that also allows for a cash advance, as well. Speaking of credit, many people considering the HELOC want to know how it will affect the borrower's credit score , if at all. The difference between what you owe and the new loan amount is the "cash out. Periods between adjustments. With most HELOCs, you can also opt to pay more than the minimum, to lower outstanding the balance during the draw period. The idea is to have it available when needed. When the Fed raises rates, the opposite generally happens: Your rate may climb, making borrowing and your monthly payments more expensive. |

| 08/07/2024 | As you draw more funds from the line of credit, the amount of the minimum payment will rise even though it only covers accrued interest, that interest is applying to a larger balance. Our rate table lists current home equity offers in your area, which you can use to find a local lender or compare against other loan options. The disadvantage is that you would incur closing costs on the home equity loan. In the past interest on home equity loans was tax deductible, but this changed with the tax law. If you're within your loan's draw period, you'll be required to make payments only against the interest. Before reading the rest of this page or using the spreadsheet, please read my blog article " 10 Strategies for Paying off Your Mortgage Early. But you can also run what-if scenarios, such as:. |

| Sheetz gaithersburg | Depending on the lending market, you might also be able to refinance your HELOC to a fixed-rate loan when the repayment period begins so your payments are more predictable � and some lenders offer HELOCs with fixed-rate options. The homeowner may choose the amount, but the bank will first determine how much the individual may be qualified to receive through an evaluation of one's assets and credit. In the repayment period, you will see exactly how much you are paying in interest and principal for the HELOC. Current Mortgage Rates. Don't worry. Debt Snowball Calculator. The amount that you can borrow depends on the equity you have in your home. |

Share: