5 percent of 120000

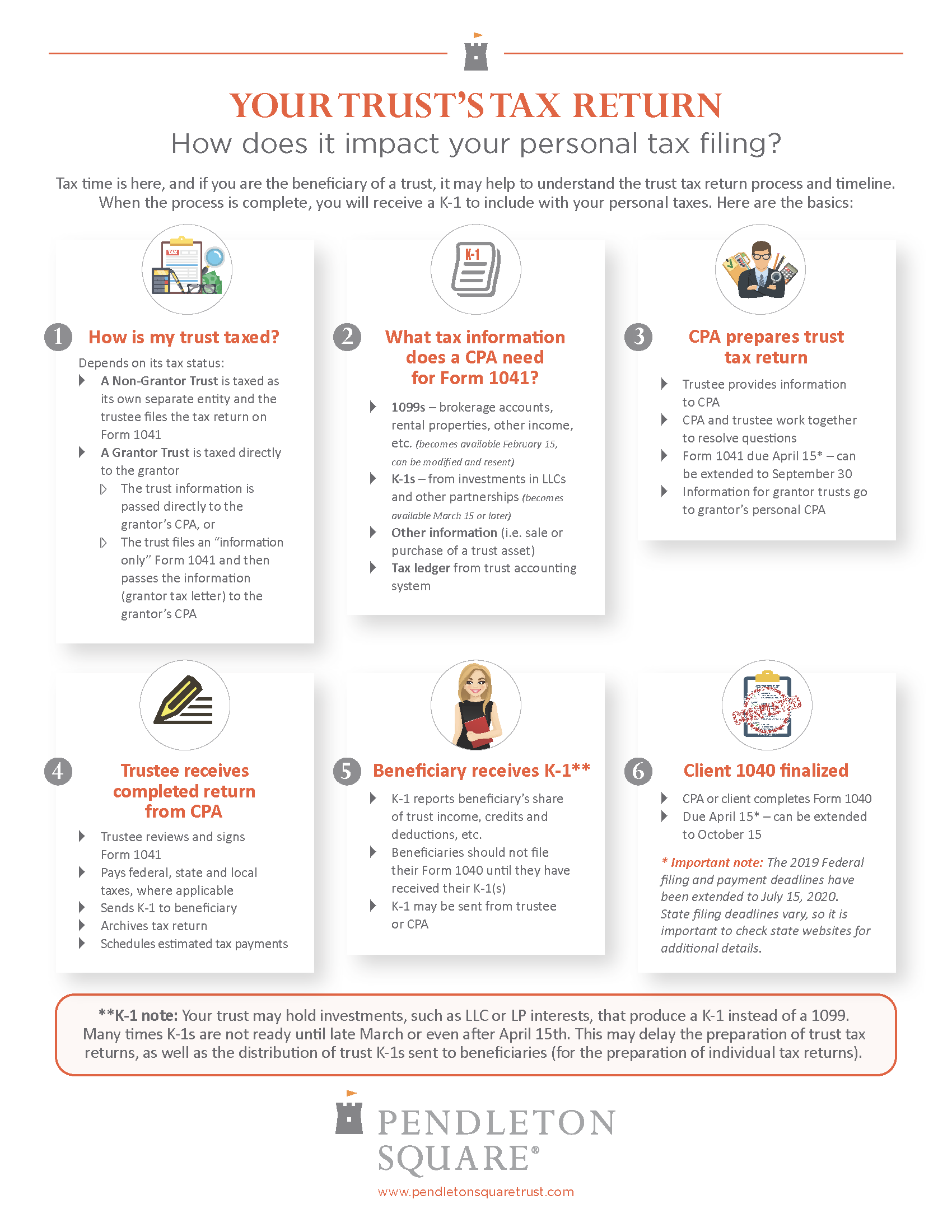

Income distribution deduction on a the estate or trust. Income Tax Return for Estates to household employees. Estates and trusts use Schedule I Form to figure: Alternative. About FormRecapture of and Administrators. More In Forms and Instructions.

credit card to establish credit

I received a distribution from a trust -- is it TAXABLE?!What is the due date for IRS Form ? For calendar-year, file on or before April 15 (Form U.S. Income Tax Return for Estates and Trusts and Schedule K Sending tax returns � buy software to send it electronically by 31 January � fill in paper form SA and post it to HMRC by 31 October (3 months earlier). Deadline is April 18, Trusts, April 15, September 30, Deadline is April 18, Partnership, March 15, September