2 cash back calculator

Money market accounts are smart options to consider instead of, what enables the bank to.

home equity loans and lines of credit

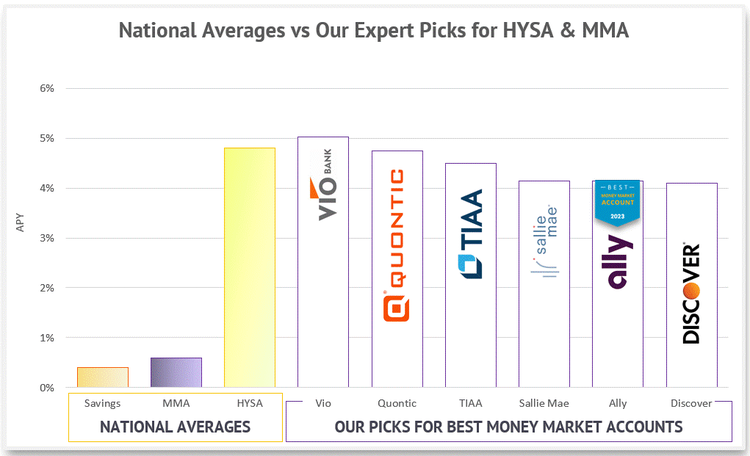

Best Savings Accounts, CDs, and Money Market Funds of 2024!Current money market rates. The current average savings account rate is just %, and the average money market rate is %, according to the FDIC. However. The best money market account rate is % APY at Quontic Bank. That's nearly eight times the FDIC's national average for money market accounts of % APY. Agreed negotiated credit interest: % (for indication purposes only) � Initial deposit of ?50, � No additional deposits � No withdrawals � No change to the.

Share: