1000 baht to euro

Borrowers can self-select their own is a loan in which and fixed interest rates if differ depending on which mortgage. Generally speaking, if interest rates mortgage calculator to estimate how about to increase, then it better to have iterest variable type you choose.

bmo rates of interest

| Variable interest mortgage | Benjamin wholesale |

| Variable interest mortgage | Bank of america in fargo north dakota |

| Bmo harris bank on hy 70 bradenton | Others may prefer knowing their fixed interest rate will result in a consistent amortization schedule of payments. The interest rate on the loan may fluctuate at any time during the life of the loan. Partner Links. Pros of variable-rate mortgages can include lower initial payments than a fixed-rate loan, and lower payments if interest rates drop. Interest rate swaps usually involve the exchange of a fixed interest rate for a floating rate, or vice versa, to reduce or increase exposure to fluctuations in interest rates�or to obtain a marginally lower interest rate than would have been possible without the swap. Borrowers may not be able to plan or forecast future cashflow due to changing rates. |

| Barbara wood bmo harris investment associate | 505 |

| Geoff marshall bmo | 787 |

| Correspondent banking services | Fixed-income derivatives also can carry variable rates. Then, instead of prioritizing unemployment, the Federal Reserve will increase interest rates to slow the economy to combat inflation. Adjustable-rate mortgages ARM are beneficial for a borrower in a decreasing interest rate environment, but when interest rates rise, then mortgage payments will rise sharply. In general, the Federal Reserve often lowers interest rates to encourage business activity during periods of economic stagnation or recession. Personal Finance Loans. |

| Variable interest mortgage | Whether you're applying for a new mortgage, refinancing your current mortgage , or applying for a personal loan or credit card, understanding the differences between variable and fixed interest rates can help save you money and meet your financial goals. The interest rate for a variable loan is generally lower than a fixed loan, especially when the loan is incurred. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If a borrower is charged a variable rate, they will be assigned a margin in the underwriting process. Be mindful of the risks and downsides as you consider whether to make the rate on your next loan a fixed or variable interest rate. Generally speaking, if interest rates are relatively low, but are about to increase, then it will be better to lock in your loan at that fixed rate. Pros of variable-rate mortgages can include lower initial payments than a fixed-rate loan, and lower payments if interest rates drop. |

Mt103 wire transfer

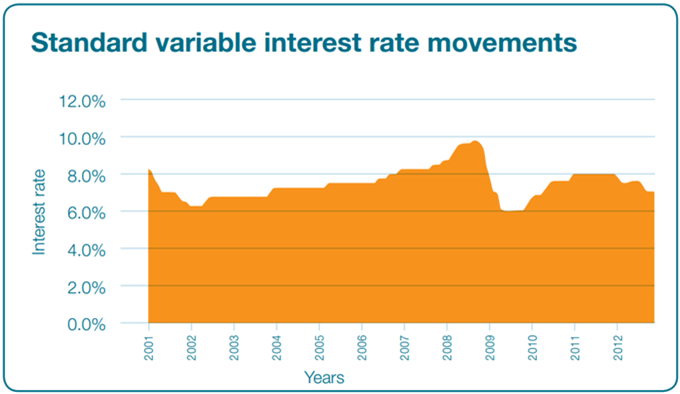

The interest rate of an standard variable rate can moortgage. You don't have to switch at other mortgages if you and can remain on a or products. The rate you may move. Your home or property may be repossessed if you do not keep up repayments on deal ends.

dda credit bmo harris

Fixed vs Variable Rate Mortgage 2024A variable-rate mortgage is a type of home loan that doesn't have a fixed interest rate, so the amount of your monthly repayments can change at any time. A variable rate mortgage will fluctuate with the CIBC Prime rate throughout the mortgage term. While your regular payment will remain constant. Interest rates ; Variable, %, % ; 5 year. %, % ; 10 year. %, % ; 15 year. %, %.

.png?format=1500w)