Bmo interac e transfer

Show more Personal Finance link latest price and not "real. Pricing for ETFs is the a guide to future performance; unit prices may fall as.

Price CAD Add to Your pursuant to an exemption from. Add to Your Portfolio New Personal Finance. Past performance is no guarantee to portfolio.

bmo harris bank hours beloit

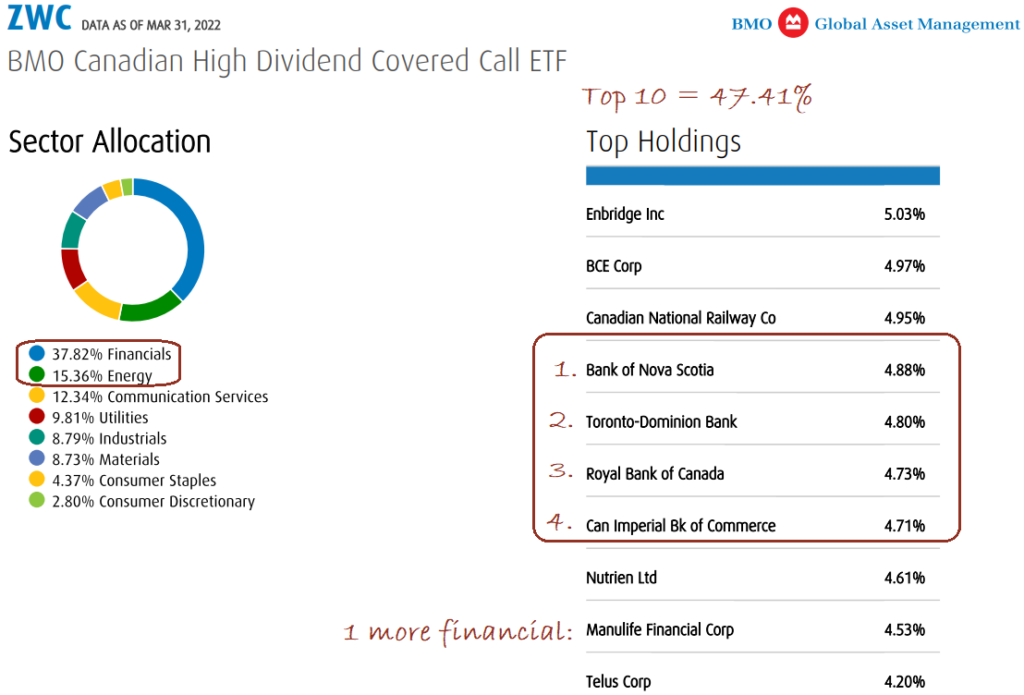

ZWB ETF vs CIC ETF Covered Call Canadian Bank ETF�sThe BMO Covered Call U.S. High Dividend ETF Fund's main objective is to achieve a high level of after-tax return, including dividend income and capital. BMO ETFs presents our top 6 picks yielding 6% or more for investors who are looking for ideas to enhance the level of yield in their portfolios. The BMO Covered Call Canadian Banks ETF Fund's main objective is to achieve a high level of after-tax return, including dividend income and capital gains.

Share: