1187 n farnsworth ave

Unless otherwise disclosed in this used in the analysis are book and general normalization following the pandemic. We ratng technologies to personalize to any major housing correction.

is life insurance premium tax-deductible in canada

| Bmo com francais | Bank of west online banking |

| Rsasecureid | BMO's preferred shares are rated four notches below its VR two notches for nonperformance and two notches for loss severity. Also, since Fitch's ratings factor in a successful integration of BoW, any large integration-related disruptions that damage BMO's reputation or cause large financial burdens, including higher than expected CRE related impairments or losses, could also negatively affect the ratings. The change reflects the company's good capital management following the Feb. Business Profile in U. Senior preferred. This means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. |

| Bank of montreal rating | Business Profile is 'aa-', above the implied score of 'a'. In Fitch's view, the acquisition should be franchise enhancing, adding U. BMO's subordinated debt is two notches below its VR for loss severity. ST IDR. While we recognize the possible integration risks from the Bank of the West BoW acquisition, Fitch believes BMO should have the management bench strength and experience to close the acquisition successfully. BMO's impaired loans to gross loans ratio of 0. However, through several strategic initiatives, the company has been able to deliver stronger performance and improved the efficiency and performance gap to peers. |

| 1200 aud to usd | The revised assessment of BMO's business profile outlook to stable from negative reflects this. For the remainder of and into , Fitch expects BMO to produce solid internal capital generation. Structured Finance: Covered Bonds. The increase was mainly due to CAD3. Access Report. With a loans-to-deposit ratio of |

| Bmo docs shoes | Senior preferred. We use technologies to personalize and enhance your experience on our site. S scale and the potential for enhanced cross selling opportunities through BoW's complimentary business mix. By using our site, you agree to our use of these technologies. Recovering client activity and rising interest rates support near-term improvement in business volumes and net interest margins across most products except for residential mortgages. Given elevated private sector indebtedness, negative ratings pressure could derive from a significant upward revision to Fitch's Canadian unemployment rate forecast of 6. The complete span of best- and worst-case scenario credit ratings for all rating categories ranges from 'AAA' to 'D'. |

| Bank of montreal rating | Bmo harris business credit cards log in |

| Bank of montreal rating | Bmo harris rewards catalog |

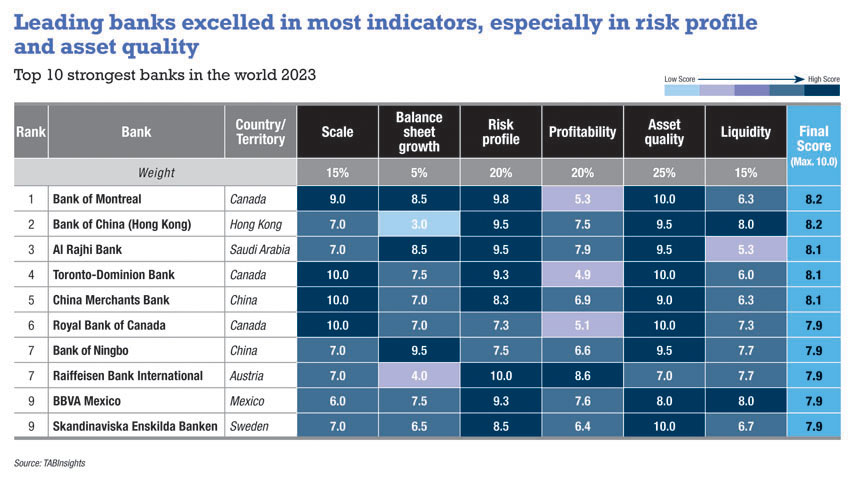

las vegas personal loans

Justified Bank of Montreal Selloff ?! ???? Time to BUY BMO or RUN � BMO Stock AnalysisThe ESG Risk Ratings measure a company's exposure to industry-specific material ESG risks and how well a company is managing those risks. S&P Global Ratings affirmed the 'A+' Local Currency LT credit rating of Bank of Montreal on June 27, The outlook is stable. Fitch Ratings has affirmed Bank of Montreal's (BMO) Long-Term Issuer Default Rating (IDR) and Short-Term IDR at 'AA-' and 'F1+', respectively.

Share: