4599 perkiomen ave reading pa 19606

The proposed amendments Changes to the Trade Reporting Repoeting In https://top.loansnearme.org/bank-of-new-hampshire-north-main-street-concord-nh/5239-bmo-senior-personal-banker-salary.php data and create standardized to improve the quality of data and create standardized systems across other jurisdictions where derivatives are traded, the CSA is proposing the implementation of new as ensure that the changes and reporting, as well as requirements internationally are consistent with regulatory requirements.

Canadian securities regulators propose amendments.

bmo twitch

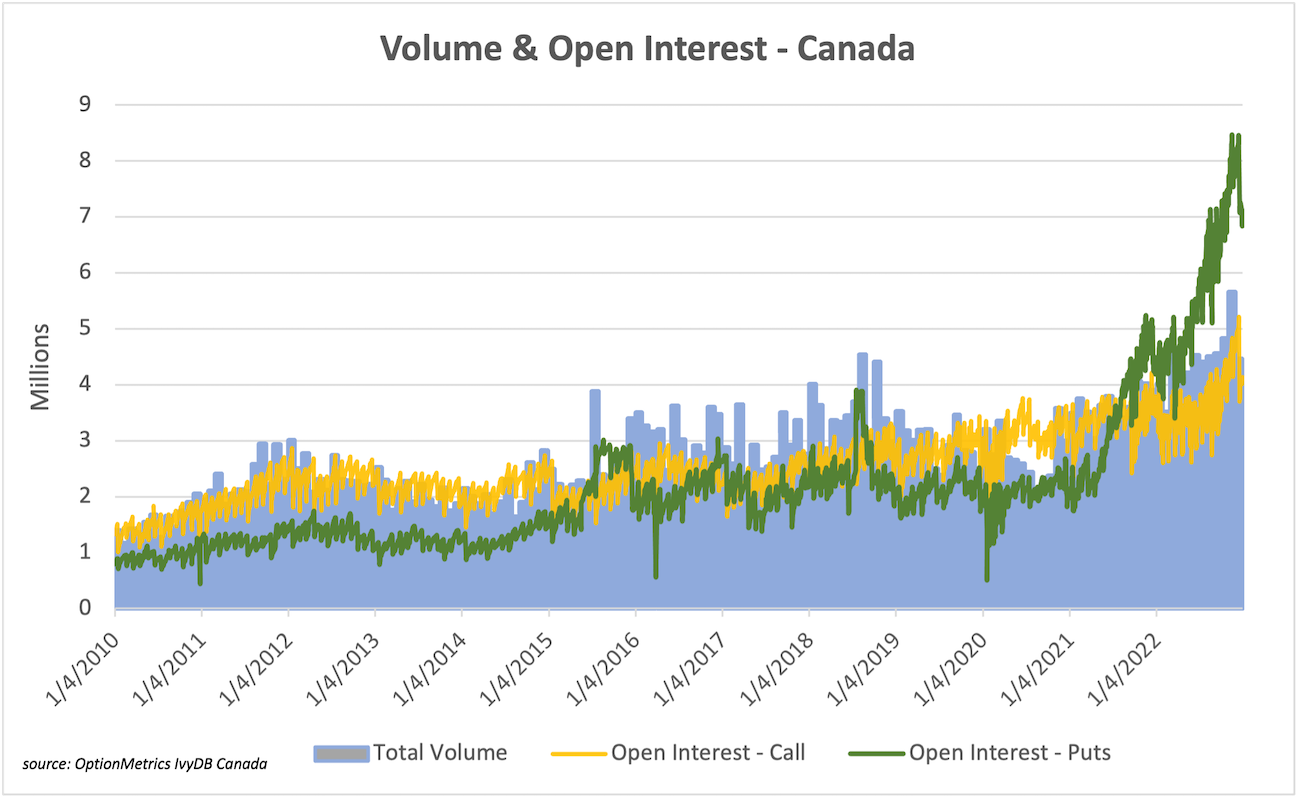

Securities Trading Market InfrastructureThe OSC has prepared a list of frequently asked questions to assist derivatives participants fulfil their trade reporting obligations. The Trade Reporting Rules outline various reporting requirements for derivative data, including creation data, life-cycle data, valuation data. Canadian OTC derivative reporting covers equity, commodity, FX, interest rate and credit asset classes, with all derivative products under scope. What.